do pastors pay taxes reddit

Rules on gifts given by your church. Legally a lot of pastors dont report everything they are supposed to.

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look

Requiring churches to pay taxes would endanger the free expression of religion and violate the Free Exercise Clause of the First Amendment of the US Constitution.

. Pastors are able to opt out of social security if they so wish. For 2018 that is 124 for Social. The tax code makes no distinction between.

Since 1943 Murdock v. If you file Form 4361 you will not. If most money is going toward charity theyd have huge tax deductions if its going toward making people millionaires then they would rightly pay their tax.

There are pastors who get paid a lot and pastors who make almost nothing. By taxing churches the government would be empowered to penalize or shut them down if they default on their payments. The church should issue him a W-2 and then it is his business whether he files is taxes or not.

Its been a few years so some of these tax implications have changed. Its a whole different. Also pastors can exempt out of Social Security so they dont have to pay out that money.

Press J to jump to the feed. This is completely acceptable as the. Pastors Are Dual Status Taxpayers.

A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that. A pastor has a unique dual tax status. However a pastor can absolutely have their church withhold federal and state income taxes from their weekly or monthly payroll check.

First pastors can tax exempt part of their salary for housing allowance so anything going towards home purchase payments maintenance utilities etc can be defined as exempt from income tax. This income is considered employee wages. For instance I know pastors in the same denomination in one.

Pastors may voluntarily choose to ask their. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes. This means a church normally wont withhold.

Its ridiculous that they dont. 105 the United States Supreme Court has ruled that the First. Its not about churches not paying taxes its that non-profit organizations dont pay taxes.

Churches should have to pay taxes. So all pastors have to pay both the employer and employee portion of their payroll taxes. Ministers are not exempt from paying federal income taxes.

There are a lot of factors that go into pastors pay. But yes they pay income taxes in the US. A tax exemption has much the same effect as a cash grant to the organization of the amount of tax it would have to pay on its income.

I think they should. 417 Earnings for Clergy. Some pastors may have conscientious issues with Social Security and Medicare so the IRS makes it possible to be exempt from those taxes.

He primarily did this cause the parsonage was paid off and if the church hit hard times. The IRS could also impose penalties on your pastor and church leaders. A number of factorsthe size of the church the local cost of.

First all ministers by. The US Supreme Court confirmed this in McCulloch v. Churches are exempt because they are non-profit organizations.

Most of the taxes that go to churches are exempt by law. And churches theatres charities shelters etc are non-profit organizations. Setting a pastors compensation is a complicated issue says CPA Stan Reiff a partner with the accounting firm CapinCrouse.

Can A Church Help Pay Payroll Taxes. The moment your church decides to give your pastor a gift of appreciation you must determine if the gift is taxable or if the gift falls under an exception. But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes.

Churches and the Church of England run tax-free endowment funds to pay the church rent and provide capital. Pastors pay under SECA unless they have opted out in which case they pay nothing. There are some basic facts that you need to understand about taxes for pastors before we get into how to pay them.

The very best comments on reddit as submitted by the users of reddit. The money they collect goes to paying for staff preacher secretary cleaners maintenance of the. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks.

While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS.

For Some Evangelical Has Become Uncomfortable Label

Resisting Disinfodemic Media And Information Literacy For Everyone By Everyone Selected Papers

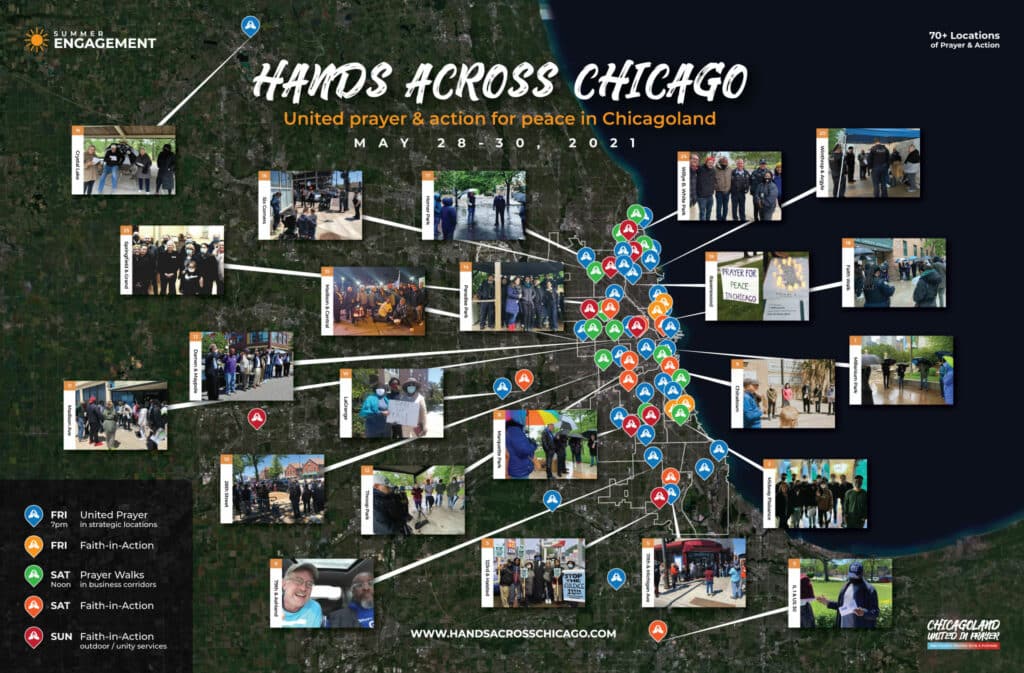

Hands Across Chicago Chicagoland United In Prayer

Good Grief Podcast Guilford County Nc

Daughters Of Gizelle Jamal Bryant Apparently Now Arizona S In Dekalb

Pastor Shot 6 Times Returns To Church It S Good To Be Home The Spokesman Review

How Pastors Sabotage Their Financial Well Being Florida Baptist Convention Fbc

The Gospel Of Prosperity The Denver Post

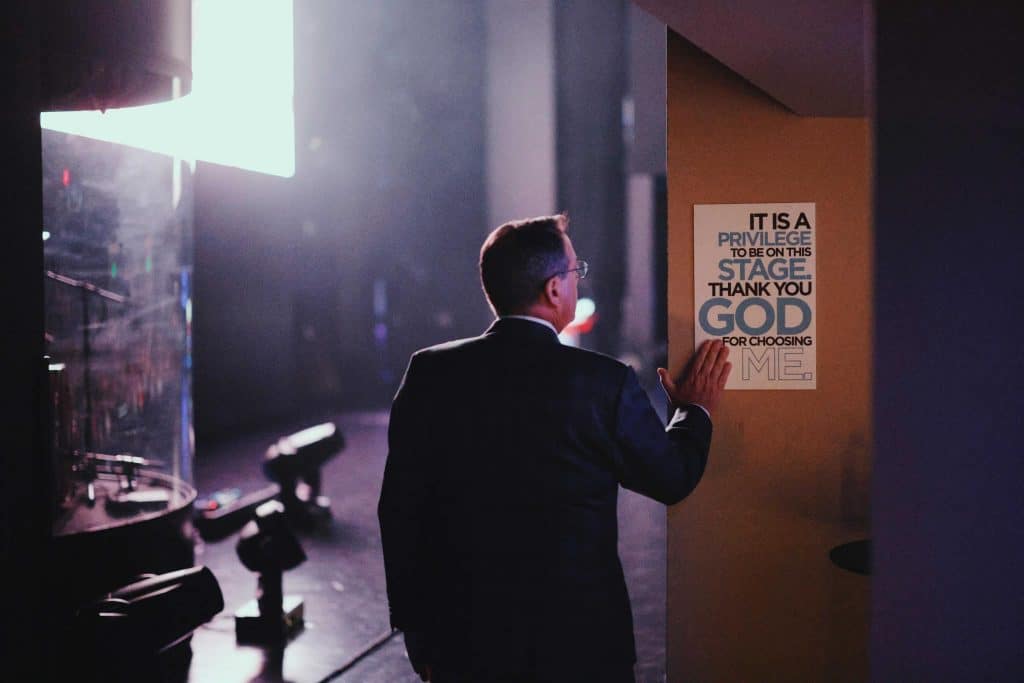

What An Amazing Pastor R Awfuleverything

As United Methodist Church Prepares For Split Colorado Churches Pray For Unity

Tax Mistakes Ministers Quarterly Tax Estimates Nonprofit Cpa

Russia Ukraine War Some Pastors Wonder About End Of Days Boston Herald

Despite Scandals Al Megachurch Invests Millions To Restore Pastors

My Pastor Was Just Fired For Preaching Two Sermons About The Sin Of Racism And Our Duty As Christians R Christianity

At The Pulpit Gateway Pastor Mentions Candidates For Gcisd School Board R Grapevinetx

The Big Ask Battlecreek Church Senior Pastor Alex Himaya Goes To The Well One More Time Seeks 50 Million The Wartburg Watch 2022

Why Franklin Graham S Salary Raises Eyebrows Among Christian Nonprofits Lifestyle Gazette Com