how to calculate stock up rate

For example say a stock is worth 25 per share before it pays you a 2-per-share yearly dividend. It can and will rise and fall based on a variety of factors in the global landscape and within the company itself.

Weighted Average Price Calculator Plan Projections Price Calculator Weighted Average How To Plan

Then raise this to the power of 1 divided by the number of years you held the investment.

. The formula is shown above PE x EPS Price. Enter the number of time units between the beginning and ending EPS entries. As defined by trading partners the percent of retail locations stores or SKUs with a positive on-hand balance of a particular item or the percent of retail locations stores or SKUs with an on-hand balance greater than a set minimum quantity.

Enter the purchase price per share the selling price per share. You should take this calculation of stock rotation analyse your business and draw conclusions about the. To get an accurate values just add the initial and final inventory of the specific time period and then divide it by two.

Take the division of total costs by the average inventory and you will be presented with your inventory turnover. You would need to know how many items in the store and how many outages there are and also if any items of an empty spot are in the back room. Take the percentage total return you found in the previous step written as a decimal and add 1.

This takes your total investment to 4000. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Average Inventory Inventory at the Beginning of the Period Inventory at the End of the Period 2.

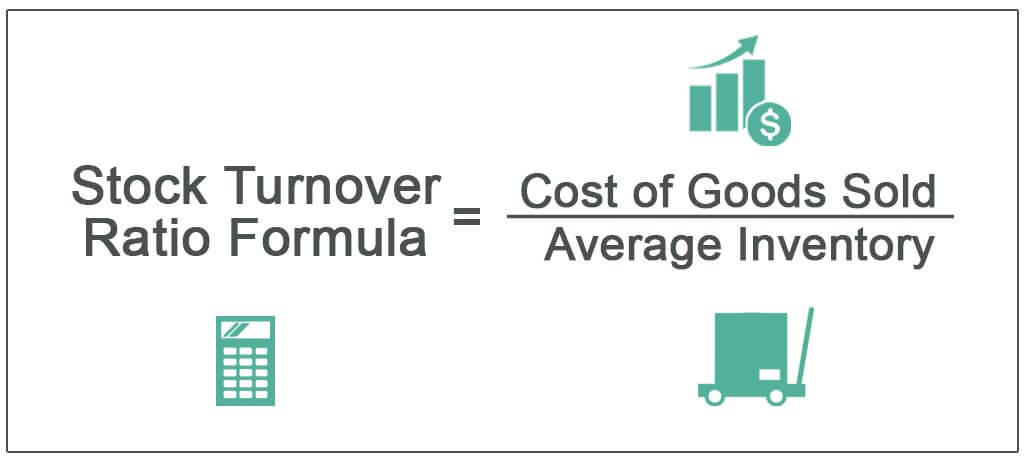

The stock turnover ratio formula is the cost of goods sold divided by average inventory. We use this formula day-in day-out to compute financial ratios of stocks. To calculate this analysts will multiply the market price by the companys trailing 12-month earnings.

The Stock Calculator is very simple to use. Add together your investments in individual stocks all-stock investment funds and stock holdings in hybrid. The algorithm behind this stock price calculator applies the formulas explained here.

Net return on investment frac sale proceeds-sale commissions cost basisbuy commissions net return on investment cost basis buy commissionssale proceeds sale commissions. GR ending value beginning value 1n - 1 where n is the number of years assuming interest is compounded annually. Finally the formula for a stock turnover ratio can be derived by dividing the cost of goods sold incurred by the company during the period step 1 by the average inventory held across the period step 2 as shown below.

This ratio helps improve inventory management as it tells about the speedy or sluggish flow of inventory being utilized. Based on this information I can calculate Johnson Johnsons expected value as. Add any dividends paid to the value of the stock at the end of the period to figure the actual closing value.

For example if you brought 100 stocks of company A rate of 10 per stock and bought 200 stocks rate 15 per stock and so on. Consider the actual performance of the stock over a period as though you had invested in it on that first day of the period. Finding the growth factor A 1 SGR001.

Multiply 60 percent or 06 by 400000 for a 240000 stock ownership in that fund. Additionally look at how the stock has done year to date YTD as. In this case the formula for growth rate is.

As per the above your capital gains amount to 8000. Johnson Johnson has historically averaged a total return of about 12 so Ill use that for the required return. The tool computes your net stock return on investment using this formula.

Calculating growth rate reveals how your company is trending. Back to Calculator Back to Calculator Back to Stock Calculator Back up to Stock Calculator. Click the Calculate Stock Growth Rate button.

Select the time units you wish to use when entering the number of periods. Enter the ending earnings per share. Computing the future dividend value B DPS A.

The measurement of SKUs being in stock and available for. The price is a reflection of the companys value what the public is willing to pay for a piece of the company. This is because you originally invested 4000 and sold the shares for 12000 five years later.

If the price goes down to 23 as a result of the. Dividends reduce the value of the stock but the shareholders receive the funds. A stock price is a given for every share issued by a publicly-traded company.

Multiply that by 1000 shares and your total profit is 8000. On each share you made a profit of 8 12-4. The stock turnover ratio determines how soon an enterprise sells its goods and products and replaces its inventories in a set duration.

And finally if you choose to compute the compound annual growth rate. Enter the number of shares purchased. Calculate per share rate of return on a stock sale in terms of current yield and annualized holding period yield.

Just follow the 5 easy steps below. In the first case 100 multiply with 10 and get 1000. The stock average calculator is a free online tool for calculating the average price of stocks and the average down calculator is best for averaging.

According to this formula if we can accurately predict a stocks future PE and EPS we will know its accurate future price. Enter the commission fees for buying and selling stocks. This formula isnt perfect as it assumes that the growth rate is constant over the period youre looking at but it manages to capture how interest affects growth.

Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001 Then the following indicators are computed. This method of predicting future price of a stock is based on a basic formula.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Wacc Calculation Accounting And Finance Finance Lessons Finance Investing

Irr Vs Roi Infographics Here Are The Top 4 Difference Between Roi And Irr Personal Finance Infographic Investing

Fundamentals Of Ratio Financial Ratio Debt To Equity Ratio Equity Ratio

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Cash Budget Investing

What Is The Rule Of 72 A Simple Definition And Examples Rule Of 72 Simple Definition Investing

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Common Stock Formula Calculator Examples With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values

Best 5 High Return Shares 2021 High Cagr Stocks In 2021 Stocks With Cagr More Than 50 Investing In Stocks Stock Analysis Penny Stocks To Buy

Stock Turnover Ratio Meaning Formula Calculate Interpret

19 95 Calculate Your Heart Rate Training Zone At A Glance Using Our Great Heart Rate Chart T Heart Rate Training Workout Posters Heart Rate Training Zones

How To Calculate Weighted Average Price Per Share Fox Business

Fixed Exchange Rate Meaning Pros Cons Examples And More Exchange Rate Financial Management Accounting And Finance